Opening Doors Through Literacy

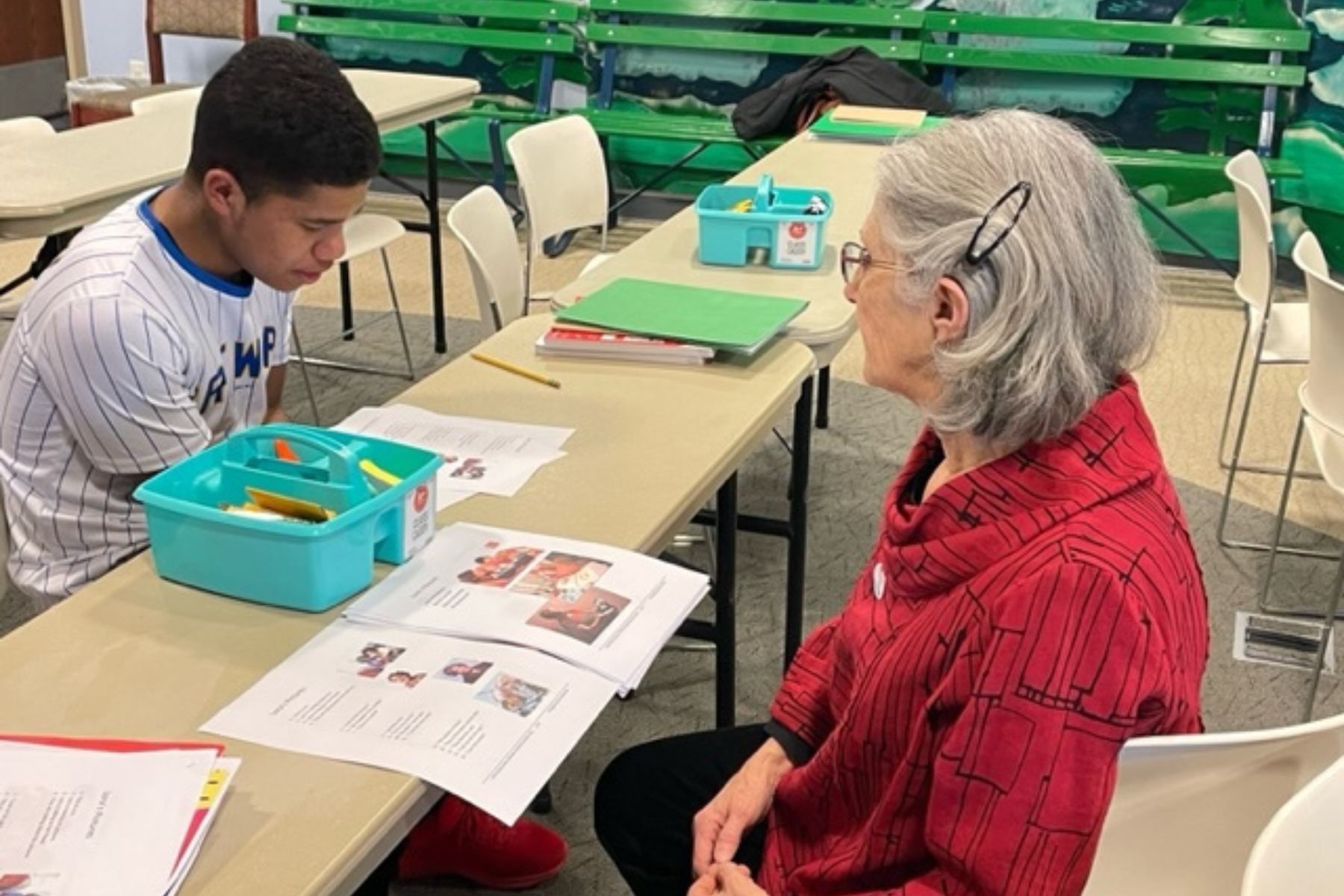

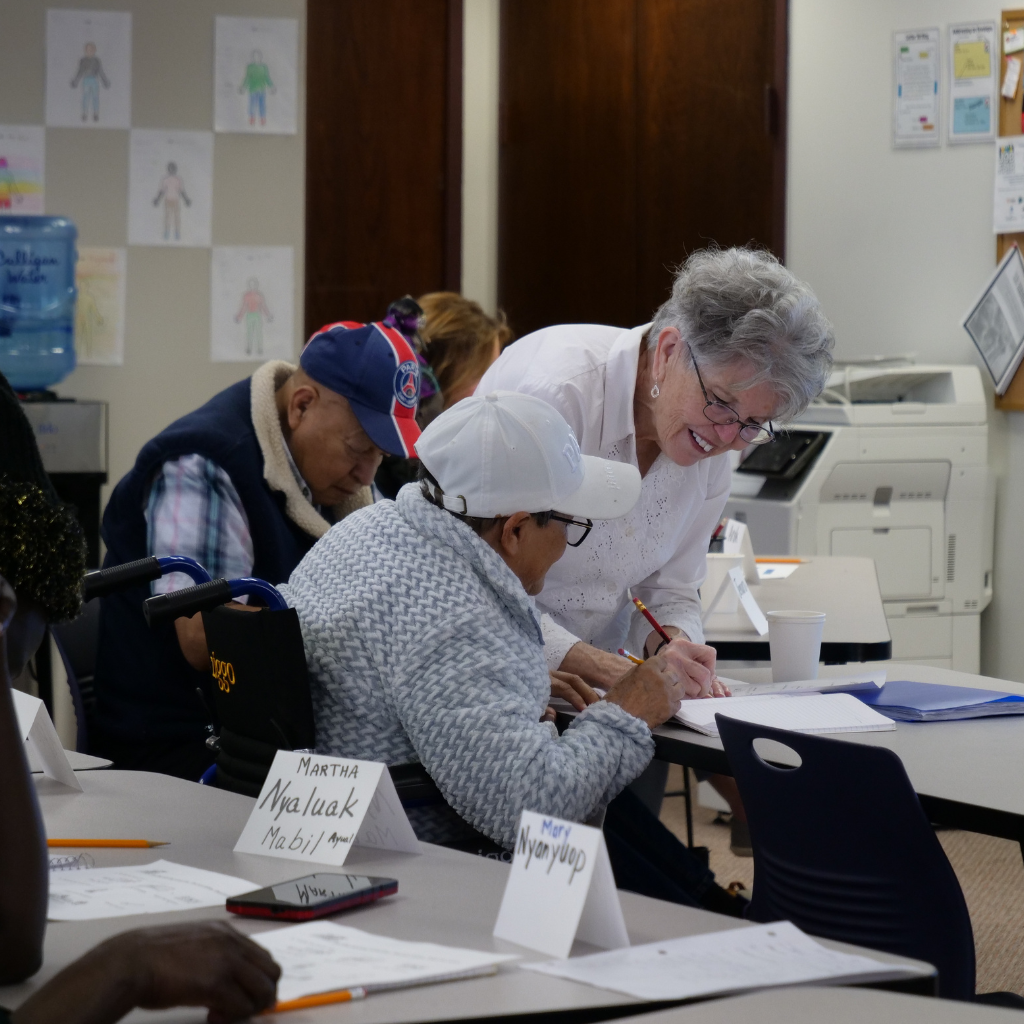

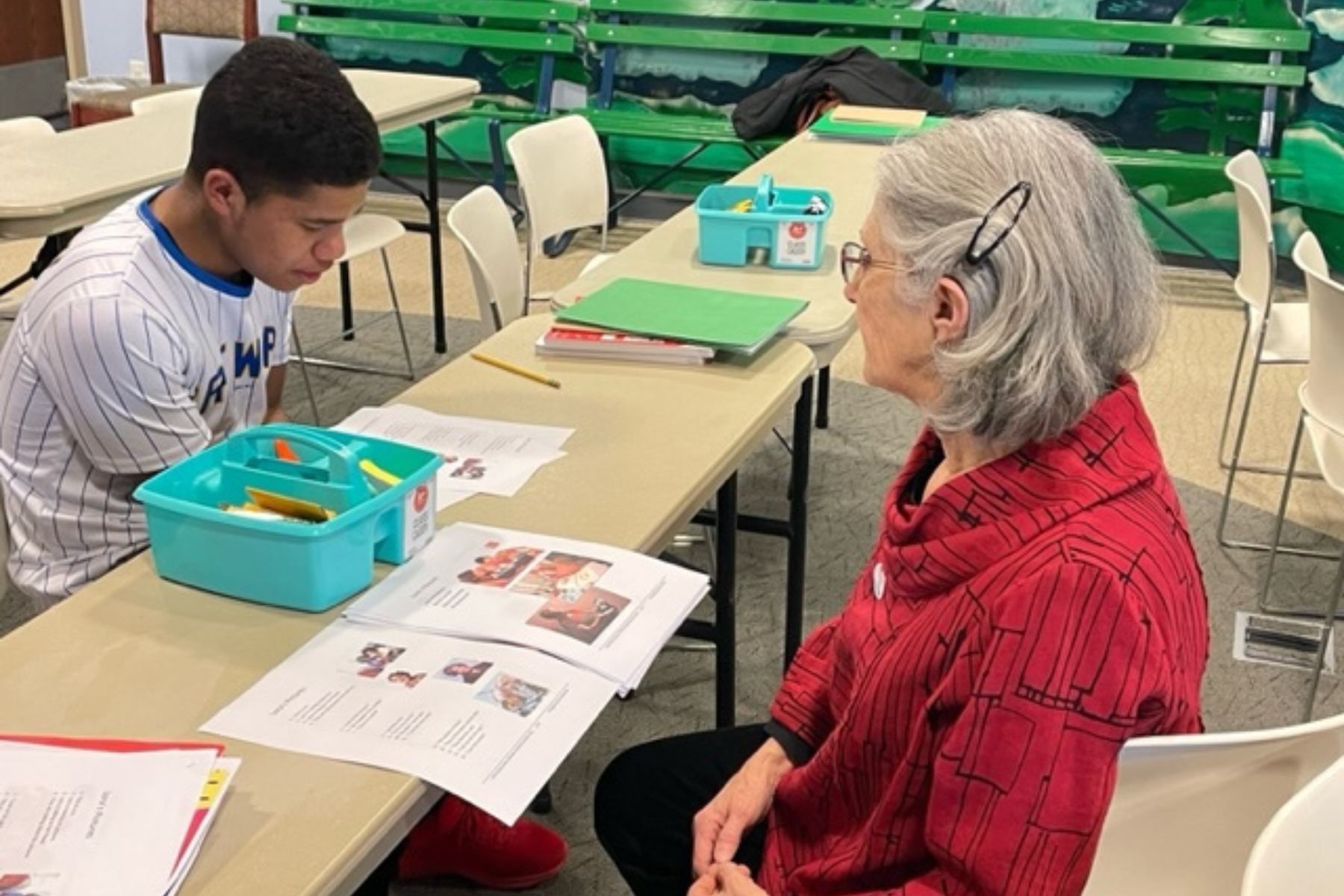

Help us strengthen our communities by eliminating literacy barriers through learner-centered programs, advocacy, and career development support.

Let's Eliminate Barriers Together

400 ACTIVE LEARNERS

At the Winnebago Area Literacy Council, we actively have 400 learners coming to our programs and utilizing our resources

150 ON AVERAGE

On a weekly average, we serve 150 learners across our six distinct programs – from Women & Children, to Workplace Literacy, and even our ESL classes.

COST FREE

For free, WALC opens doors to an accessible education for learners – eliminating additional barriers like childcare and transportation

Every word opens

a new world

Through our influence, the Winnebago area will be known for valuing, promoting, and supporting literacy so that our residents achieve sustained independence and truly thrive.

Check out the latest posts from our blog - Beyond The Margins

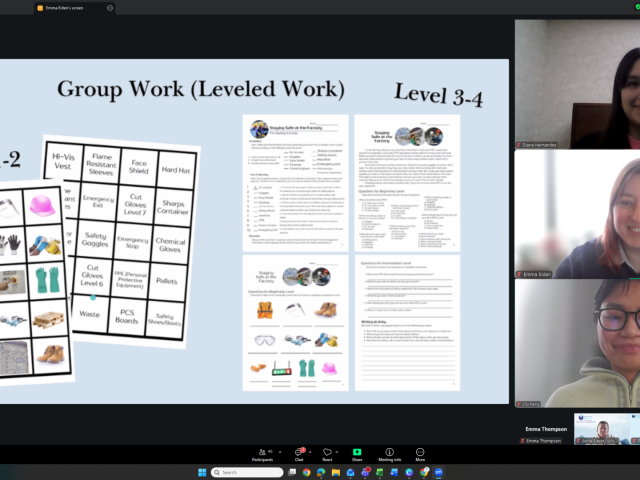

Sharing What Works: WALC Presents on Workplace Literacy at Wisconsin Literacy Conference

Winlit_admin – March 6, 2026

WALC's Workplace Literacy program was a topic of discussion at Wisconsin Literacy's Winter Conference last...

Read More

February 2026 Newsletter

Winlit_admin – February 23, 2026

February 2026 NewsletterDownload

Read More

Teacher Spotlight: Machaela Jackson

Winlit_admin – February 23, 2026

Say hello to Machaela Jackson! Machaela is an ELL teacher at WALC's Learning Center, as...

Read More